Click More until you see Payroll, Click Payroll

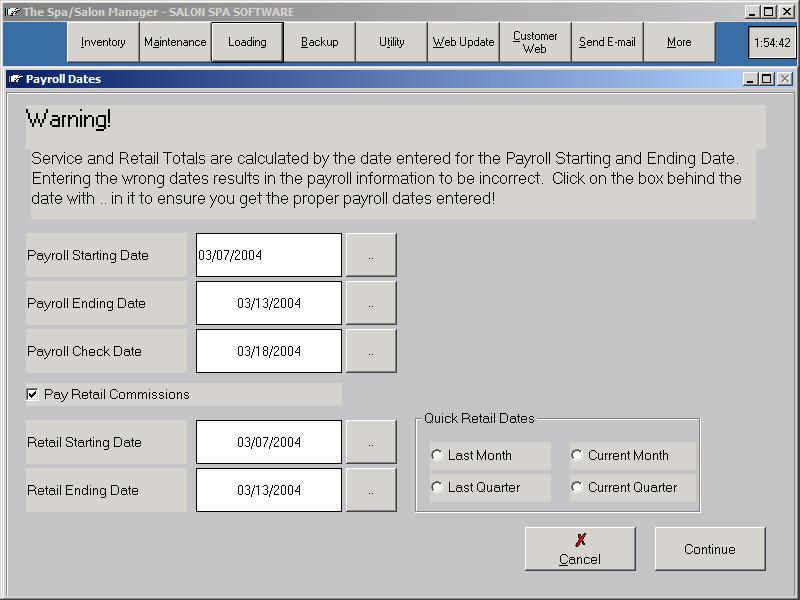

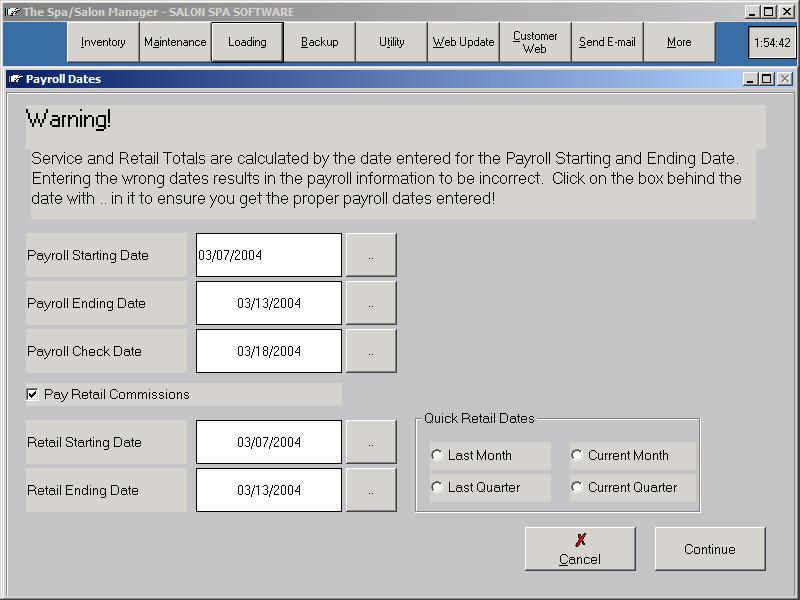

Processing Payroll is accomplished by entering the payroll dates for the pay period. Totals are accumulated by the dates entered. If the dates are entered incorrectly, the payroll information will be WRONG. Be sure to enter the dates correctly. Click the .. after the date prompt and a calendar is displayed to make sure you have the correct dates. The Payroll Check date is the date that will be printed on the payroll check. The Payroll Check date will only appear if you have the optional Payroll Manager program.

Retail Dates by default are the same as the Payroll Dates. This allows for retail commissions to be paid each pay period. If you do not want to pay retail commissions, click the Pay Retail Commissions and the system will not calculate retail pay for that week. The Retail Starting and Ending Date can be entered allowing you to pay retail commission monthly, quarterly or any date period. The system will calculate the retail sales during that date range and display during the payroll process.

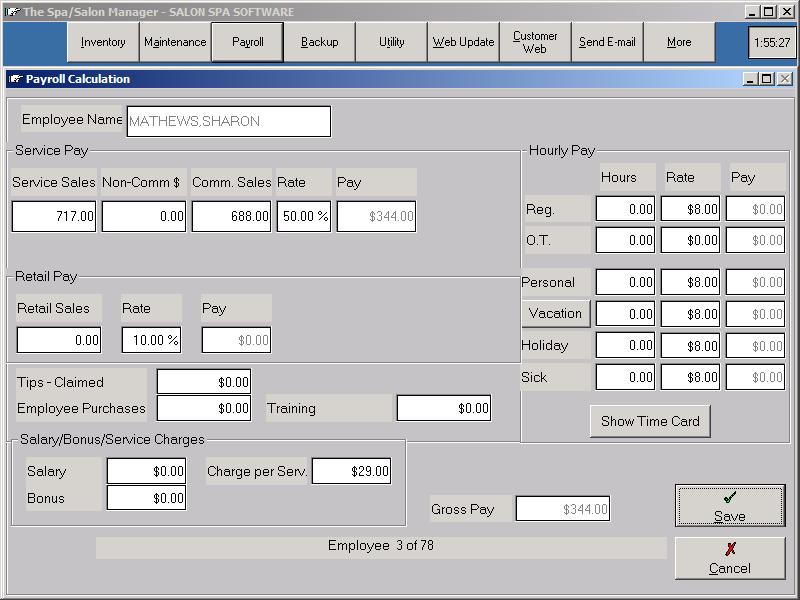

Press the Calculate Payroll to start the payroll process. The system shows the Service, Retail and hours worked with regular and overtime pay. The system calculates service charges and subtracts them before or after commission depending on the option chosen. Verify the payroll calculations, change any information needing correction and press Continue.

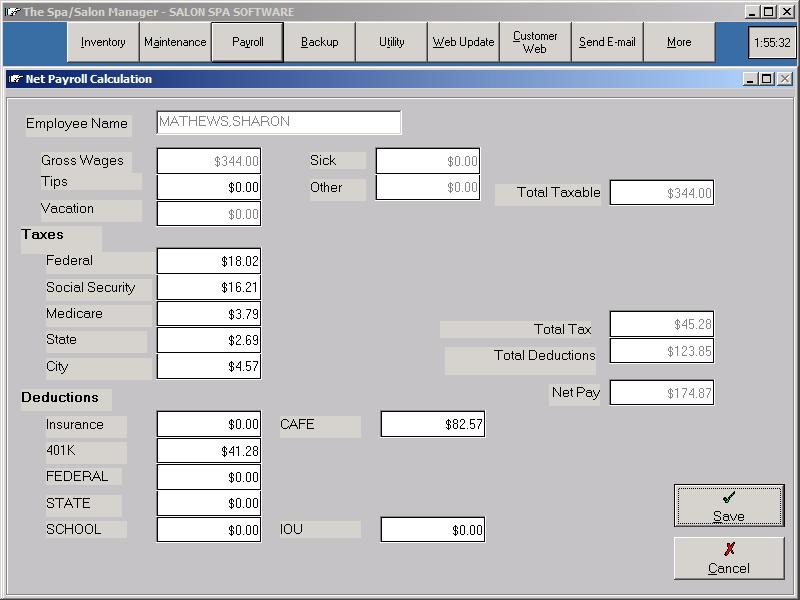

The Optional Net Payroll Manager calculates the taxes for the Gross Wages confirmed in the Calculate Payroll section. The Net Payroll Manager is integrated into the Payroll Calculation to have a easy-to-use payroll. The first step calculates the Gross Wages while the second step calculates Federal, State, City and deductions to be withheld. The Payroll Calculation screen only allows for the Tip information, tax amounts and deductions to be changed. The Gross Pay amount can be be changed. If the amount needs modified, hit the Cancel button to go back to the Payroll Calculation screen.

Once the Net Payroll information is confirmed the next employee for the Payroll Calculation is displayed. This continues until all employees are processed.

The Reports button provides a detailed report of the calculation of Gross Wages for each employee. This can be printed from the Owners, Date Range Reports at any time, but a printout is available to send to an accountant if needed.

The system allows for a Employee Gross Pay Report which could be included in the employee paycheck to show how the gross wages were calculated. This report is not mandatory to print as it could be printed from the Owner, Date Range report at any time.

Check printing can be accomplished by printing All Checks or individually. Computer printed checks look professional and include all the information regarding the payroll. The payroll check stub includes the Service, Retail, Hourly information and taxes withheld. The system supports a laser check which is Quicken compatible (Check at top, followed by two stubs).

The Payroll Check Register is a concise report showing the check number, gross wages, taxes withheld, total deductions and the net pay for each employee on a single page.

The End of Period prints the final report for the payroll period. The Payroll Summary provides the total for the wages paid, total taxes withheld and totals for all deductions. The system calculates the payroll tax payment due and shows the liabilities that the business is required to pay for the payroll processed. After the Payroll Summary, the Employee Payroll Summary report is available. This report shows the wages, tax and deduction information for the payroll period for each employee in detail. The report lists three employees to a page to minimize the amount of paperwork to be sent to an accountant. This report is available at any time through the Reports, Owner, Date Range.

Generally the Unemployment Report is processed once per month after the last payroll of the month. The Unemployment Report has several options which include to subtract 401K wages, subtract CAFE wages and subtract Sep-IRA wages. Each state is different concerning the options required to produce the correct report to file with your state. Check with your accountant on the correct options to select. Note: If you don't have any deductions for CAFE, SEP-IRA or 401K their is no need to check with your accountant.

W2's are printed once per year. W2's can be printed at any time. If you have an employee leave your employment, a W2 can be printed once they receive their last payroll check. Most employees prepare the W2's after the last payroll check during the calendar year.

The 941 Worksheet is designed to aid in the preparation of quarterly reports. The system prints out the information accumulated during payroll that corresponds to the 941 Employer's Quarterly Federal Tax Return. All information should be verified with your accountant, since tax payments are the responsibility of the business owner.

Mistakes are inevitable and the Correct Void/Check allows you to change payroll check information that has been processed. Note: If you change the wages of an employee, payroll checks stubs printed in the past may not reflect the current wages. The system will automatically recalculate the employees wages and print the correct totals on the next check for the employee.