Post Accounting

The Spa/Salon Manager posts automatically to the following program:

- QuickBooks Pro/Premier (All versions after 2004)

QuickBooks Setup:

- QuickBooks must be installed on the computer before using Accounting Setup in Spa/Salon Manager

- Start QuickBooks and log on as the Account Administrator

- A company file must be created with a least one checking account

- All QuickBooks updates must be current and QBFC3_0Installer must be executed from the Spa/Salon Manager CD

- Click My Computer, CD-ROM Drive and right click hitting Explore. Double click on QBFC3_0Installer

- Minimize QuickBooks by clicking the underline at the top right corner

- Start The Spa/Salon Manager

- Click More until you see Maintenance

- Click Maintenance

- Click Accounting Setup

- Choose QuickBooks

- Click Find Data File (Select your accounting file by clicking on the name)

- Click Save

QuickBooks will begin to flash at the bottom of your screen. Click on QuickBooks to display the screen below.

Checkmark the "Allow this application to access Social Security Numbers and other personal data."

Click Yes, Always

IBCS, Inc. is waiting for the digital certificate from Intuit. Click, Yes to allow The Spa/Salon Manager to access the QuickBooks company file.

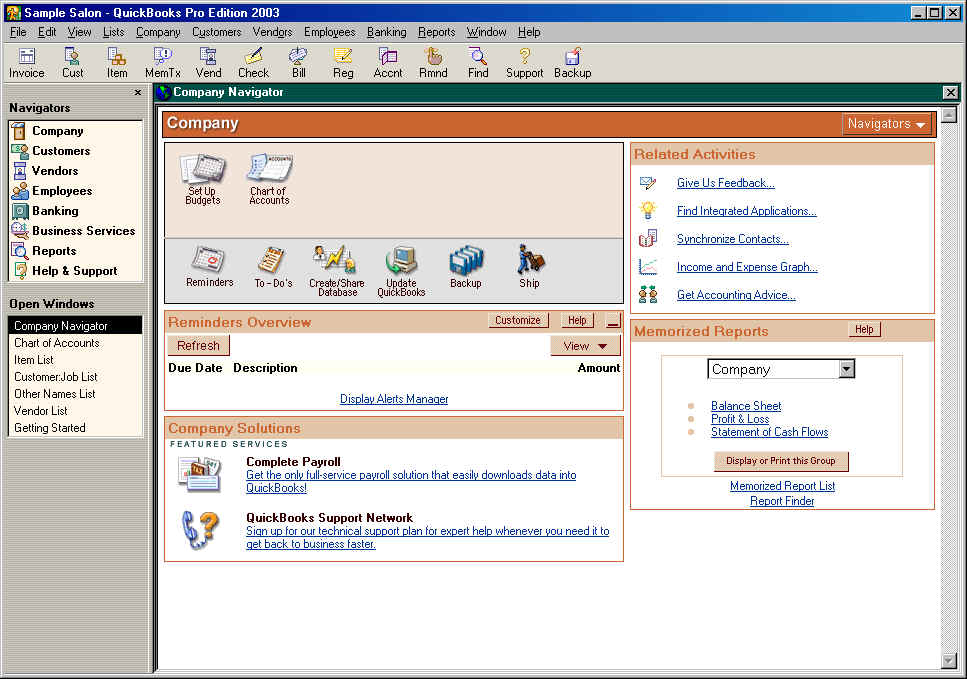

QuickBooks will now show the normal opening menu as shown.

Click Edit

Click Preferences

Click the tab Company Preferences

Click Properties...

Checkmark the "Allow this application to login automatically"

Click OK

Exit QuickBooks

Now the system will automatically post accounting information to QuickBooks. Posting the Daily Deposits and optionally the Payroll Information.

QuickBooks Accounting Details: (How information is posted from The Spa/Salon Manager)

Items created for Daily Deposits

- Deposit-Cash going to Spa-Salon Sales

- Deposit-Check going to Spa-Salon Sales

- Deposit-{User Defined Types} going to Spa-Salon Sales for every transaction type

Each Deposit is posted to Spa-Salon Sales and the invoice is received to the Checking account.

When using the The Spa/Salon Manager - Payroll Manager (Net Taxes)

Items created by Spa/Salon Manager as a Service deducting from the Checking Account Name

- Payroll

- Payroll-pay-gross

- Payroll-pay-federal

- Payroll-pay-state

- Payroll-pay-fica

- Payroll-pay-city

- Payroll-pay-{Deduction Category Name}-For each payroll deduction category

- Payroll Spa-Salon used to show taxes to be paid

Payroll entries are posted via a Journal Entry with a Debit to Payroll Expenses and a credit to the Checking account.

Payroll Taxes to be paid are entered into the system as Vendor Bills with the vendor name Payroll Spa-Salon and an Account of Payroll Expenses.

- 941 Federal Tax Deposit

- State Taxes Withheld

- City Taxes Withheld

- IOU Withheld from employee checks

- {Other Deductions} withheld from employee checks

When posting information to QuickBooks, the screen will show the progress of each deposit and optionally payroll information. No interaction is required for the Spa/Salon Manager to post to QuickBooks after the initial setup, except for clicking the Post Accounting button.

IBCS can not provide technical support on using QuickBooks, but we would be glad to aid you in setting up the posting process.